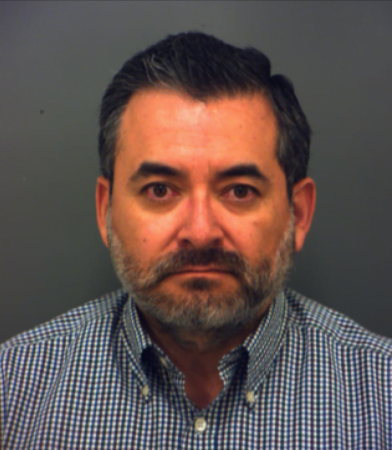

Someone who used to work at the El Paso, Texas branch of Morgan Stanley is accused of stealing millions of dollars from senior clients while they were there. Over the course of seven years, Douglas McKelvey is said to have stolen more than $3.4 million from at least 10 clients.

This week, the Securities and Exchange Commission (SEC) sued McKelvey in civil court, accusing him of stealing $1.7 million from two retired trading customers. McKelvey is 58 years old. The lawsuit says that McKelvey regularly sold securities in their names and used the money for his own purposes.

McKelvey is said to have made fake account statements to hide the missing money and hide the plan. The former advisor admitted to the scam and pleaded guilty to the charges in June of this year.

Barred From Industry

The SEC has told McKelvey he can’t work in the securities business again because of the admissions. Along with civil penalties, the regulatory body wants people who got money illegally to return it with interest.

McKelvey is also being charged with wire and bank fraud by federal officials in Texas in a separate case. For each charge, the highest prison sentence is 30 years.

Repeat Offender

This isn’t the first time McKelvey has had a problem with the law. His license was taken away by FINRA for a year in 2015 and he was fined $5,000 for giving bad advice to customers in 2008. After more than 20 years with the company, Morgan Stanley fired him in August 2022.

What the SEC calls “recent violations” happen between January 2015 and July 2022. McKelvey is said to have moved the stolen money to his personal checking account during this time and used it for a variety of costs.

Compliance Concerns

The theft that went on for years makes people wonder how Morgan Stanley checks and makes sure they follow the rules. Even though the company told the police about McKelvey when they saw problems, critics point out that the plan went on for a long time.

“It’s very troubling when brokers can take advantage of weak investors over and over again while a firm is watching,” said Duane Thompson, a former senior counsel at the SEC. “This latest black eye for Morgan Stanley suggests oversight practices need revisiting.”

The Association for Senior Investors said again that financial institutions need to make protecting their clients’ assets their top concern.

It’s things like this that make people lose faith in the system, said Michael Liersch, head of ASI. “Firms must continually reassess their controls to prevent such long-running scams against retirement savers.”

Ongoing Case

As McKelvey’s legal case goes on, the result could set new standards for what an advisor and a firm must do. People in the industry will be closely watching what happens and figuring out what it all means.

The Morgan Stanley case is most importantly a wake-up call for investors: they need to stay alert. To find financial abuse, it’s important to carefully look over monthly statements and report any strange behavior right away.